If you are registered for GST and you receive a payment from an opt-in scheme that you’ve selected to participate in, like Commercial or Pay-per-use, GST might be added to your payment when it is considered that the works that are copied and shared by licensees are taxable supplies.

For payments from the education and government licence schemes (statutory licences), International, or the artists’ resale royalty scheme, GST will not apply.

Does GST apply to the Copyright Agency Fees?

We add GST on our fee where it is required by the Australian Taxation Office (this varies depending on the member’s tax status and the licence being administered). You may be able to claim on this tax, referred to as an ITC (or Input Tax Credits) in your business activity statement or tax return – it is recommended you check with an accountant before doing this.

How do I find the amount of GST or ITC on my payments?

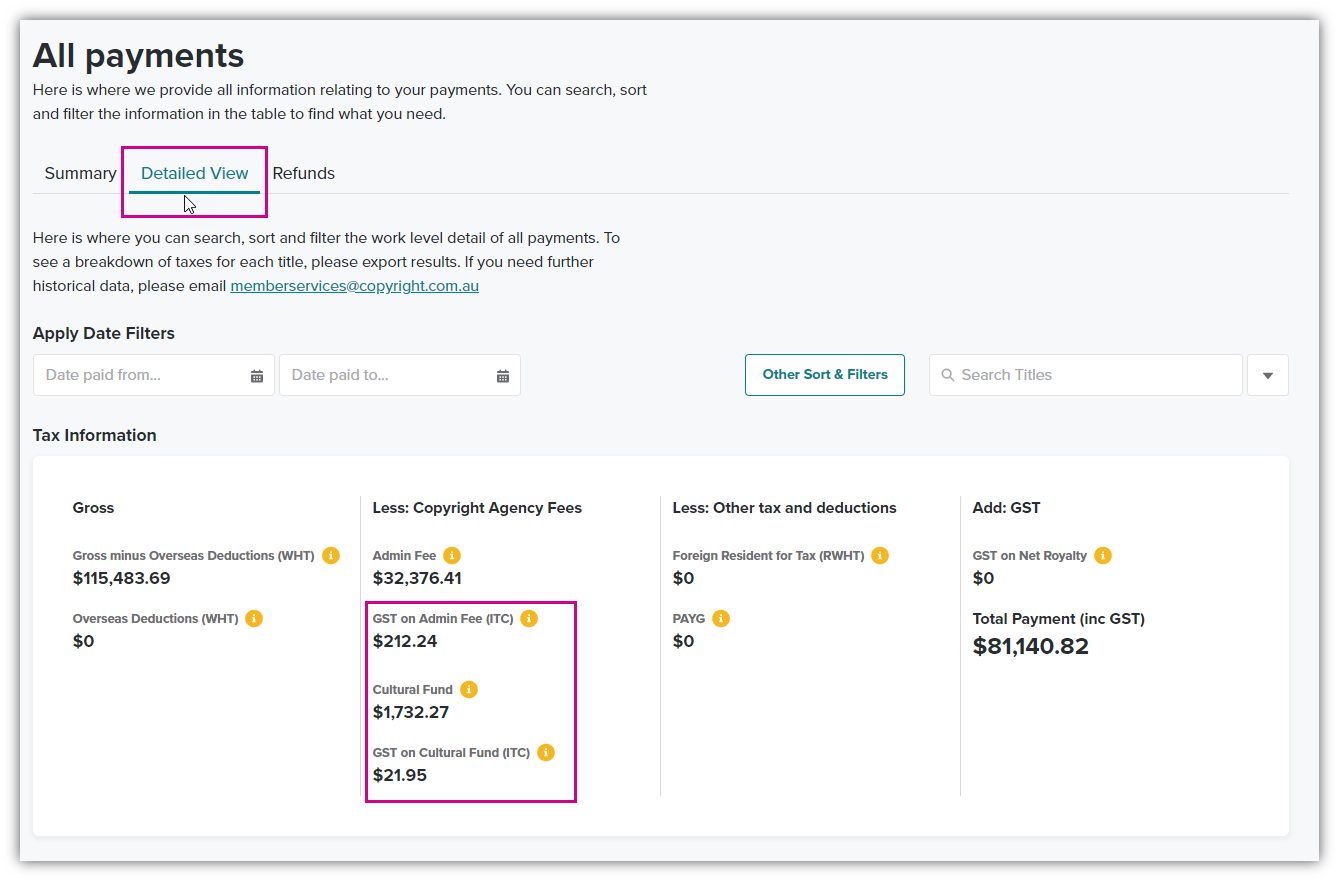

Log into your online member account, and select ‘Payments’ from the top right-hand menu. Select the ‘Detailed View’ tab to show total GST and ITCs.

These will adjust to show total amounts according to any search or filters you apply, like a date range. If you select the ‘Export’ button under the works table, you will see these taxes applied at an individual work-by-work level.

If you receive GST from us, your Payment Summary (PDF) constitutes your Recipient Created Tax Invoice (RCTI).